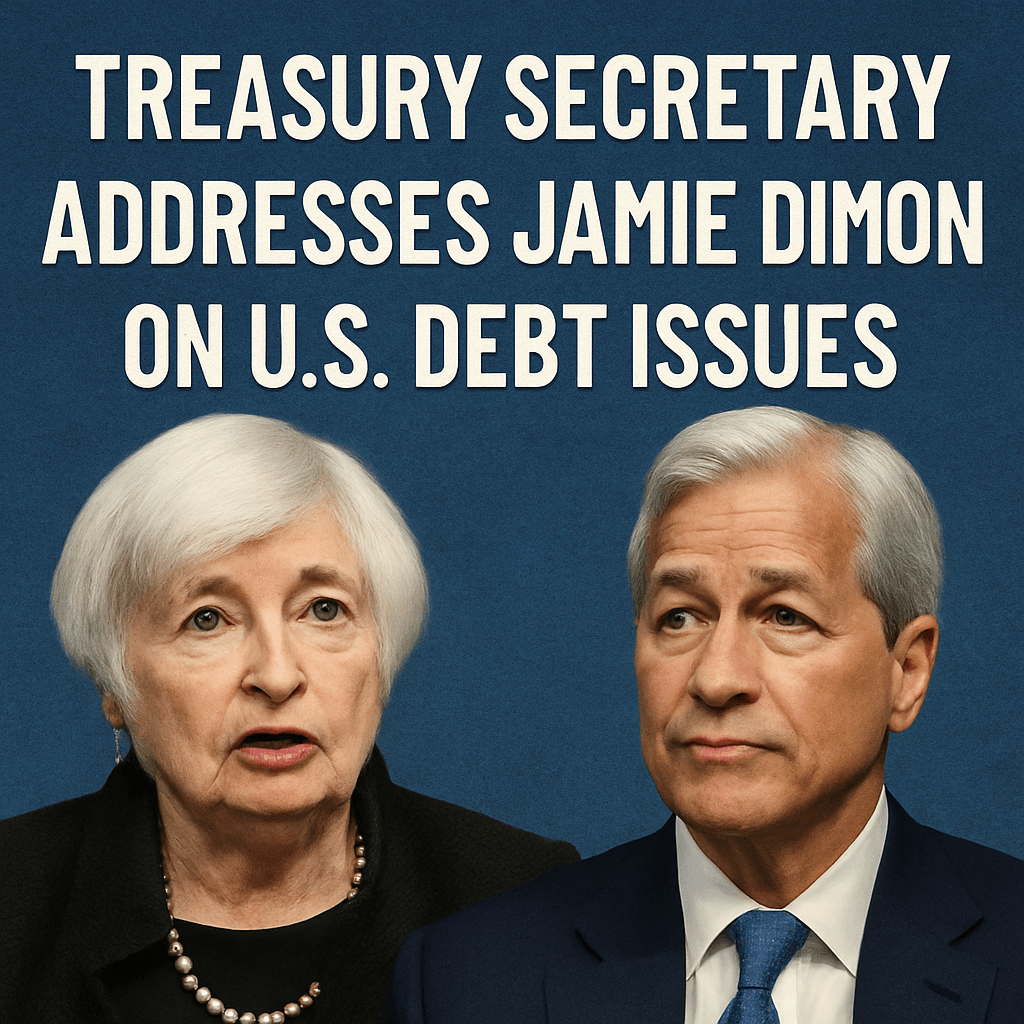

Treasury Secretary Addresses Jamie Dimon on U.S. Debt Issues

Treasury Secretary Scott Bessent recently sought to reassure markets amidst ongoing concerns about the U.S. government’s debt levels, responding to comments made by JPMorgan Chase CEO Jamie Dimon regarding potential risks for bond markets. In an interview on CBS News’ Face the Nation on June 1, Bessent downplayed these worries, suggesting that Dimon’s long-standing caution about the national deficit has historically not materialized into significant crises.

Dimon’s Long-Standing Concerns

Jamie Dimon, a prominent figure in the banking industry and a noted deficit hawk, has consistently voiced his concerns about the implications of U.S. government spending on bond markets. He reiterated his worries during a gathering at the Reagan National Economic Forum, emphasizing that the staggering growth in U.S. debt could lead to rising borrowing costs.

Bessent remarked on Dimon’s predictions, stating, “I have known Jamie a long time. And for his entire career, he’s made predictions like this. Fortunately, none of them have come true.” This assertion reflects Bessent’s belief that market dynamics could counteract such pessimistic forecasts.

Analyzing Current Market Dynamics

The bond markets appear to exhibit a cautious sentiment regarding U.S. debt, which has become increasingly significant in light of recent economic events. In April, a widespread selloff in bonds culminated in rising interest rates that reached historic highs, leading to a reevaluation of trade policies. Former President Trump’s administration delayed implementing new tariffs due to this market turbulence.

Furthermore, in May, Moody’s cut its assessment of U.S. debt, a move that eliminated the highest rating previously held, causing further jitters among investors. As bond yields soared, the yield on 30-year Treasury notes crossed the 5% threshold, a notable psychological barrier that hadn’t been surpassed since before the Great Recession, aside from a brief surge attributed to inflation concerns in October 2023.

The Vicious Cycle of Debt and Rates

Dimon articulated a concerning dynamic where the issuance of Treasuries might lead investors to demand higher yields to offset perceived risks of repayment. He stated, “Something like $30 trillion of securities trades every day. These are investors around the world,” underscoring the global nature of the bond market and its sensitivity to U.S. fiscal management.

As investors keep a close eye on government policies, any perceived mismanagement could cause rates to escalate, raising the government’s borrowing costs, as well as potentially increasing mortgage rates. This situation illustrates the intricate link between fiscal policies and the functioning of the bond market.

The Path Towards Deficit Reduction

Bessent maintained an optimistic outlook, asserting that there are plans to gradually reduce the deficit over time. He pointed to anticipated revenue streams, including income from tariffs as well as savings from price controls on prescription drugs instituted during the Trump administration, which he believes will contribute to lowering the deficit. “We are going to bring the deficit down slowly,” he asserted, promising a more stable financial outlook by 2028.

Conclusion: Diverging Perspectives and Future Implications

The divergence of perspectives between Dimon and Bessent captures the complex nature of economic speculation surrounding U.S. debt and its impact on financial markets. While Dimon represents a cautious view driven by historical precedents regarding fiscal irresponsibility and its long-term effects, Bessent’s position emphasizes steady management and the potential for economic recovery.

As stakeholders monitor the evolving economic landscape, the actions taken by government and financial institutions will prove critical in determining the trajectory of U.S. debt and its influence on the broader markets.

Expert Insight: The impact of debt management on interest rates is a critical area of study for economists, particularly in the context of inflation pressures and global economic stability.

Source: fortune