Using Stop-Loss and Take-Profit Orders in Crypto Trading

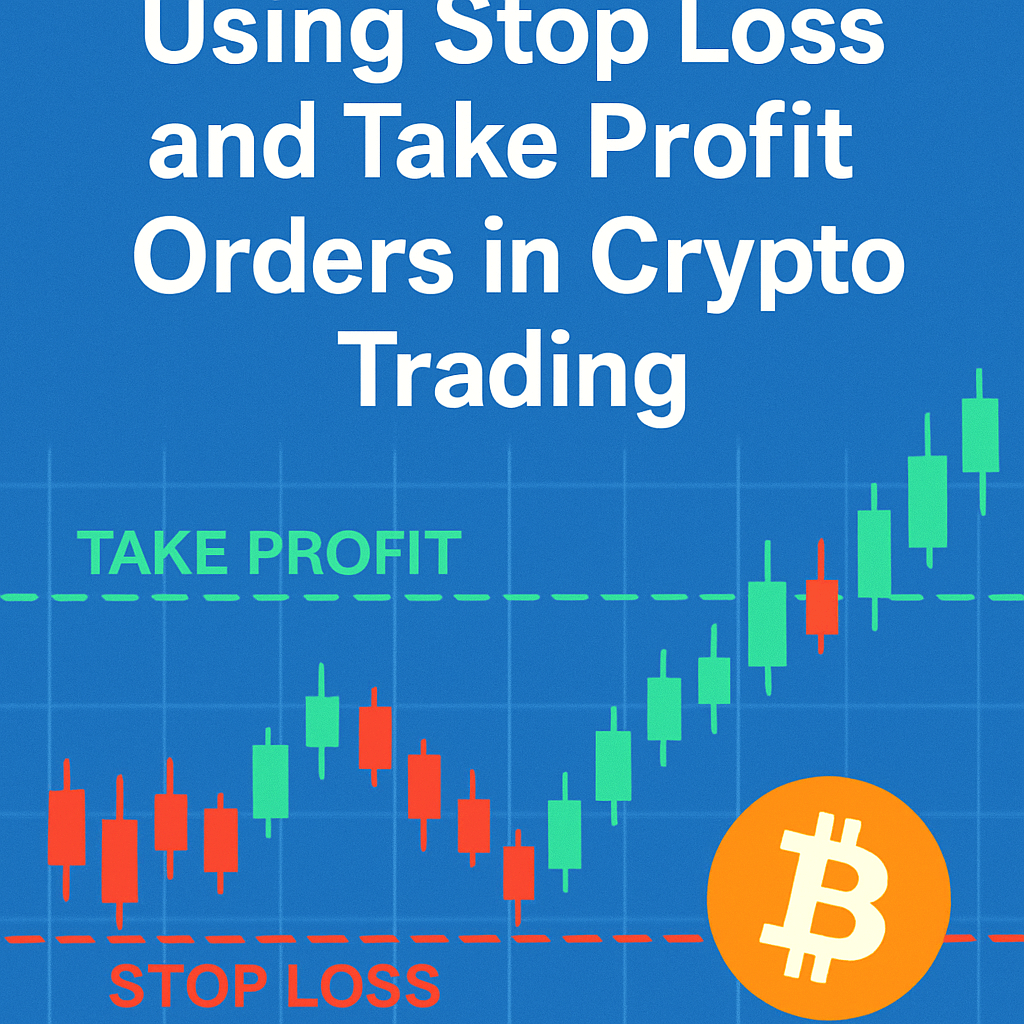

Stop-loss and take-profit orders play a crucial role in cryptocurrency trading, particularly in a highly volatile market such as Bitcoin. These automated trading tools facilitate risk management by allowing traders to lock in profits and mitigate losses without the need for constant monitoring of market prices.

What are Stop-Loss and Take-Profit Orders?

Stop-loss orders are instructions given to a trading platform to sell a security when it reaches a certain price. The primary aim is to prevent excessive losses in a drop-hazard scenario. Conversely, take-profit orders are designed to automatically sell the asset once it hits a predetermined profit target. Using these orders helps traders to manage their investment positions more effectively.

How to Set Up Stop-Loss and Take-Profit Orders

- Determine Your Entry Point: Before placing any order, it is vital to identify your entry point for the trade. This involves analyzing market conditions, technical indicators, and potentially using tools such as Fibonacci retracement levels or moving averages.

- Define Your Stop-Loss Level: The most effective stop-loss levels are often set below significant support levels or below the recent price action. For instance, a trader might utilize a percentage loss, such as 5%, or a specific dollar amount. It’s important to consider the asset’s volatility when setting this level.

- Determine Your Take-Profit Level: Like stop-loss orders, take-profit levels can be aligned with support and resistance levels determined through technical analysis. Many traders set take-profit orders at a multiple of the risk they are willing to take; for example, if the stop-loss is set at 5%, they might set a take-profit at 10% or more.

- Implement the Orders on Your Trading Platform: Most cryptocurrency exchanges provide straightforward interfaces for setting these orders. Navigate to the trading section of the platform, select the asset, and find the option to create a stop-loss or take-profit order, inputting your predefined levels.

Understanding the Benefits of These Orders

Using stop-loss and take-profit orders provides several advantages:

- Emotion-Free Trading: Automated orders reduce emotional decision-making that can lead to poor trading outcomes.

- Risk Management: These orders help define risk/reward ratios precisely, allowing for strategic trading plans.

- Market Conditions: In markets that operate 24/7, such as cryptocurrency, these orders ensure that traders don’t miss opportunities even when they are off-line.

Market Conditions and Timing

In the ever-evolving cryptocurrency landscape, understanding the market conditions is vital when placing stop-loss and take-profit orders. As of October 2023, Bitcoin has exhibited increased volatility due to macroeconomic factors and regulatory changes worldwide. For instance, recent announcements by major regulatory bodies have introduced shifts in market psychology, leading to sudden price movements. Traders should stay informed about such developments to adjust their order strategies accordingly.

Expert Insights and Strategies

Professional traders often suggest a mixed approach when setting stop-loss and take-profit levels. For instance, utilizing a trailing stop-loss can be beneficial, allowing traders to maximize upside potential while protecting gains as prices rise. Additionally, experts advocate for dynamically adjusting these orders based on market performance, rather than setting and forgetting.

“Stop-loss and take-profit orders are indispensable tools for mitigating risk and securing gains in the fast-paced realms of cryptocurrency trading,” says a seasoned cryptocurrency analyst. “Understanding market sentiment and being flexible with your strategies will further enhance your trading outcomes.”

In conclusion, stop-loss and take-profit orders are essential components of a trader’s toolkit. By effectively leveraging these tools, traders can navigate the treacherous waters of cryptocurrency markets with a greater level of confidence.